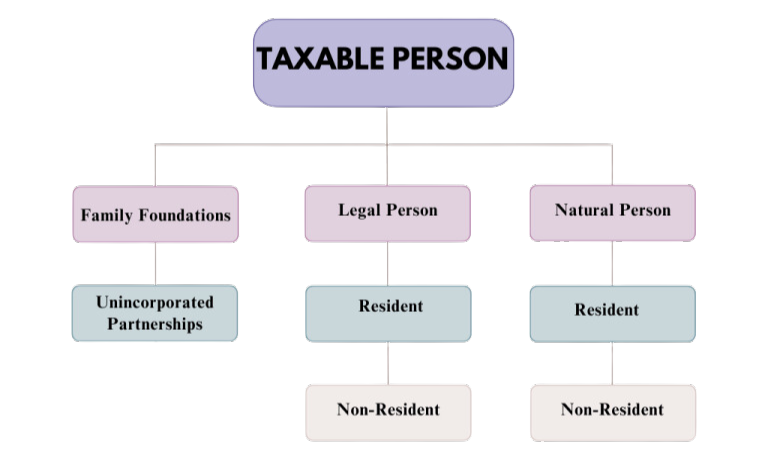

(Article 17)–Family Foundations

An application may be made to the Authority to classify as an Unincorporated Partnership provided it meets the following criteria:

- Established for the benefit of identified or identifiable natural persons, or for a public benefit entity, or both.

- Primarily engaged in receiving, holding, investing, disbursing, or managing assets or funds associated with savings or investment.

- The Family Foundation does not engage in activities that would be taxable if conducted directly by its founder, settlor, or beneficiaries.

- The primary purpose of the Family Foundation is not tax avoidance.

(Article 16)–Unincorporated Partnerships

(Article 38) – Transfer of Tax Losses

Tax losses may offset taxable income of another party provided that:

- Both entities are legal entities.

- Both entities are residents.

- One entity holds a direct or indirect ownership interest of at least 75% in the other at the start of the relevant tax period.

- Neither entity is exempt.

- Neither entity is a qualifying free zone entity.

- Both entities share the same financial year end date.

- Both entities prepare financial statements using identical accounting standards.

Tax Return

The Taxable Person must submit a Tax Return no later than (9) nine months after the end of the relevant Tax Period. The tax period corresponds to either the Gregorian calendar year or the (12) twelve-month period for which the Taxable Person compiles financial statements.

When completing a tax return for Corporate Tax (CT), include the following information:

- Tax Period covered by the Tax Return.

- Name, address, and Tax Registration Number of the Taxable Person.

- Submission date of the Tax Return.

- Accounting basis utilized in financial statements.

- Taxable Income for the Tax Period.

- Claimed Tax Loss relief amount.

- Transferred Tax Loss amount.

- Claimed available tax credits.

- Corporate Tax Payable for the Tax Period.

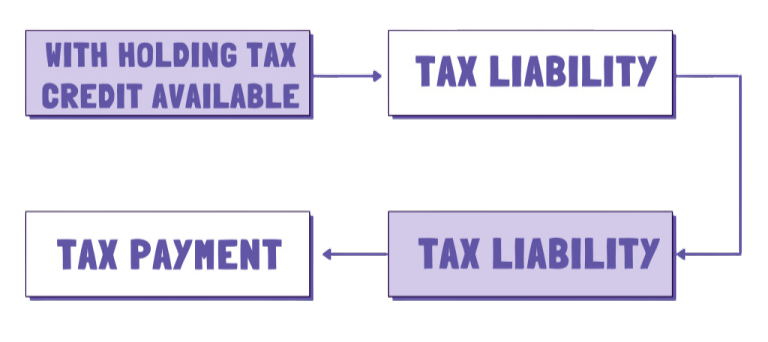

(Article 44) – Tax Settlement

The Corporate Tax due under this Decree-Law is settled in the following sequence:

- Utilization of the Taxable Person’s available Withholding Tax Credit.

- Application of Foreign Tax Credit.

- Utilization of Available Reliefs.

Any remaining tax liability must be paid within nine months from the end of the relevant tax period.

(Article 49)–Tax Refund

A Taxable Person can request a Corporate Tax refund from the Authority as per the guidelines outlined in the Tax Procedures Law under the following conditions:

Categories of Taxable Persons Obligated to Prepare and Maintain Audited Financial Statements

As per Clause 2 of Article 54 of the Corporate Tax Law, the subsequent groups of Taxable Persons are required to prepare and uphold audited financial statements:

- Taxable Persons with revenue surpassing AED 50,000,000 (fifty million United Arab Emirates dirhams) during the relevant Tax Period.

- Qualifying Free Zone Persons.

Contact us at @ +971 52 1952 532 / Email Us : [email protected] and one of our Corporate tax specialists will provide you with necessary support and consultation.

Who is responsible for registering, filing, and settling Corporate Tax?

All Taxable Persons, including Free Zone Persons, must register for Corporate Tax and acquire a Corporate Tax Registration Number. Additionally, the Federal Tax Authority may request specific Exempt Persons to register for Corporate Tax. Taxable Persons must submit a Corporate Tax return for each Tax Period within nine months from the conclusion of the relevant period. Generally, the same deadline applies for payment of any Corporate Tax owed for the Tax Period covered by the return.

FOR MORE INFORMATION, CONTACT US :

Phone : +971 52 1952 532 / +971 4 240 1110

Mail-Id : [email protected]

Website : www.yugaaccounting.com