YUGA offers premier Corporate Tax Services in Dubai, UAE, supported by skilled Consultants who will help you navigate the tax assessment, registration, and return filing processes. The introduction of corporate tax in the UAE is set to revolutionize the country’s regulatory environment, requiring companies to be fully prepared to comply with this new tax regime.

What is the necessity for Corporate Tax Services in the UAE?

Businesses in the UAE must adhere to government tax laws and regulations. Corporate tax rates are set at 0% for taxable income up to AED 375,000 and 9% for income exceeding AED 375,000. Large multinational corporations meeting specific requirements under ‘Pillar Two’ of the OECD Base Erosion and Profit Shifting initiative will be subject to a different tax rate. Corporate tax services are essential for companies to navigate the complex tax system and ensure compliance with regulations.

Using corporate tax services in the UAE offers several advantages, including:

– Accurate tax calculation and filing

– Compliance with tax laws and regulations

– Access to professional advice on tax-related matters.

– Minimization of tax liability through strategic tax planning

– Prevention of penalties for non-compliance

Furthermore, with the implementation of the UAE Corporate Tax starting this year, companies in Dubai are enhancing their strategies and objectives while ensuring compliance with tax laws. YUGA Accounting, an authorized corporate tax consultancy, offers services such as tax assessment and advisory to assist businesses in preparing for corporate tax obligations. This includes providing insights into the tax implications of various business transactions, helping companies make well-informed decisions. Remember, each business is obligated to submit only one UAE corporate tax return and related supporting schedules to the FTA for each tax period.

Complete Corporate Tax Solutions available in the UAE.

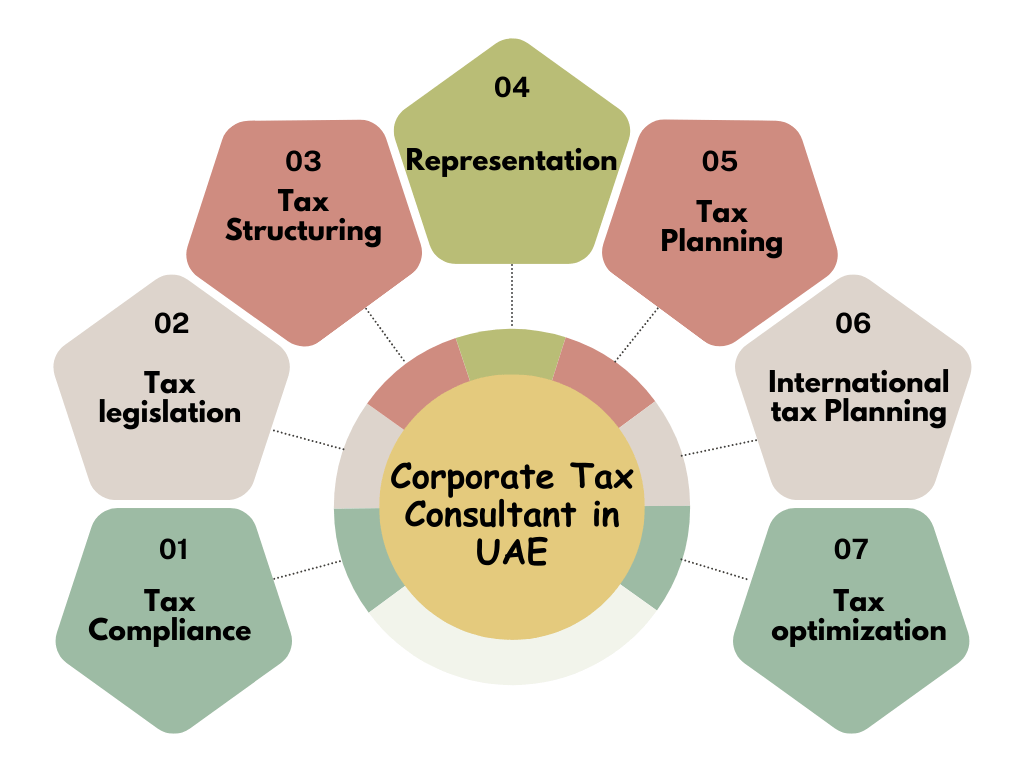

YUGA Accounting provides corporate tax services for businesses in the UAE, ensuring comprehensive coverage of all tax-related matters to uphold precise tax obligations. Our team of tax consultants in the UAE is highly knowledgeable in federal decree law pertaining to Corporate Tax, offering expert assistance in various areas.

- Corporate Tax Regulations

- Tax Rates and Exemptions

- Taxable Base for Businesses

- Free Zone Individuals

- Determining Taxable Income

- Income Exemptions

- Corporate Tax Benefits

- Allowable Costs and Expenses

- Affiliated Individuals

- Rules for Tax Losses

- Tax Group Creation

- Corporate Tax Calculation

- Tax Payment Procedures

- Transfer Pricing Documentation

- Prevention of Misuse

- Tax Enrollment and Termination

- Declaration Submission

- Breach Penalties

- Transitional Rules

- Final Regulations.

Corporate Tax Services Process in the UAE:

Our Corporate Tax Service can support your business by effectively implementing Corporate Tax in accordance with tax regulations, preparing and submitting tax returns, and offering comprehensive tax assistance through the following stages.

Assessment of tax obligations:

Our tax consultant will analyze your business operations, financial records, and other pertinent information to ascertain the taxes that your business needs to settle.

Tax planning:

Following the assessment, our tax consultant will recommend tax-saving tactics and opportunities to reduce your tax burden.

Preparation and filing of tax returns:

Our tax consultant will compile corporate tax audited financial records and file Corporate tax returns on behalf of your business, making sure that everything is accurate and in line with tax laws.

Payment of taxes:

Our tax consultant will ensure that your business settles its taxes on time and in the appropriate amount.

Representation in case of tax audits:

Should there be a tax audit, our tax consultant will serve as your business’s representative and provide assistance and guidance to ensure a smooth process.

Ongoing support and advice:

Our tax consultant will offer continuous support and guidance on tax-related issues to make sure that your business remains compliant with tax laws.

YUGA Accounting is recognized as a top choice for Corporate Tax services in the UAE. We are committed to delivering professional and efficient Corporate Tax services. With over a decade of success, we have a proven track record of working with multiple organizations, showcasing a high level of expertise and comprehensive knowledge.