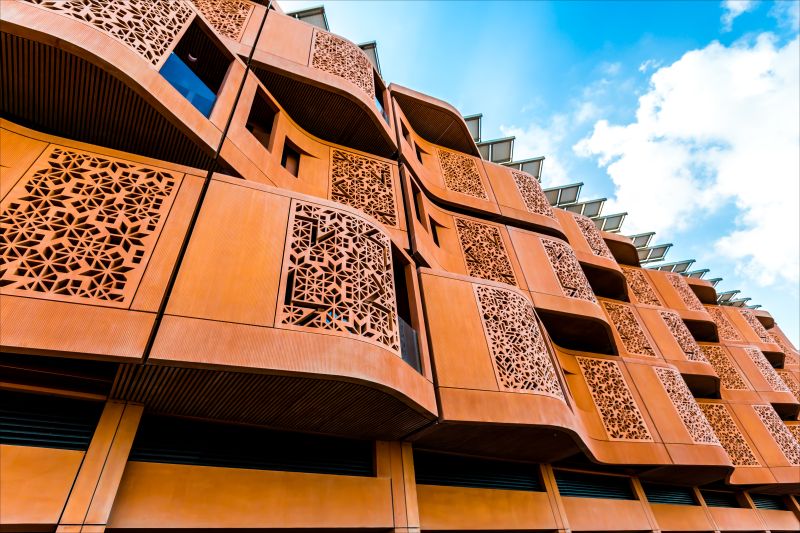

Established in 2006, Masdar City Free Zone is one of the world’s largest economic development projects. It plays a crucial role in attracting investors and entrepreneurs to the UAE. With a straightforward business setup process, commercial office spaces, and appealing regulations, owning a company here is simple, affordable, and profitable. This sector is designed to serve as a global hub for oil, gas, and energy companies to explore, research, and develop sustainable energy products. It offers a favorable environment for setting up your business, with a business-friendly atmosphere and attractive tax incentives. Here are some additional benefits:

- 100% Foreign Ownership

- Relaxed visa restrictions

- 100% repatriation of profits

- Complete exemption from person, income and low corporate taxes

- Dual licensing possibilities

- Access to both regional and international markets

- Zero import tariffs

- Close proximity to ports, airports, and highways

- Convenient location near the city of Dubai

YUGA Accounting & Tax Consultancy

✓ Contact Us

✓ +971 52-1952-532

✓ [email protected]

Built to house over 1,500 businesses and nearly 50,000 residents at any given time, the Masdar Free Zone is home to an extensive array of business possibilities. Let YUGA Accounting & Tax Consultancy help you start your business in the Masdar City Free Zone.

Masdar City Free Zone Emphasizes Four Key Areas The Masdar City Free Zone is a jurisdiction that concentrates on four fundamental aspects of the energy sector. These are:

01

Masdar Carbon

Masdar Carbon is focused on providing clean development of carbon storage facilities and mechanism projects.

03

Masdar Power

This aspect covers the power projects throughout Masdar city and other enterprises in the UK and Seychelles

02

Masdar Venture

Masdar Venture is aimed to target investments in clean energy sources and environmental services

04

Masdar Institute of Science and Technologies

This Non-profit component focuses on the research and education surrounding the development of clean or alternative energy sources.

Documents and Steps Needed to Acquire Your Business License in the Masdar City Free Zone

Company formation in Masdar City Free Zone is designed to be straightforward and hassle-free. However, even with its simplicity, there are several key documents and steps you need to understand if you plan to successfully own and run a business in this jurisdiction.

Steps to Get Your Business License

- Choose a Business Activity

- Submit License Application

- Register Your Business Name

- Pay the Required Fees

- Open a Corporate Bank Account

- Secure Your Business License

Required Documents

- A business plan

- Articles of Association

- Shareholder details or parent company information

- Director and Manager’s details

- Board resolution from parent company

- Memorandum of Association

- Passport-sized photos for all shareholders

- Copies of visas for shareholders if the hold resident visas in UAE

Legal Entities in Masdar City Free Zone

When establishing a business in the Masdar City Free Zone, you have the option to choose from various legal structures. These frameworks dictate how profits, losses, and risks are managed by you and your shareholders. Let’s explore how you can decide on the right legal structure for your business.