Yuga Accounting offers top-tier corporate tax services, ensuring professional and timely corporate tax registration in the UAE to comply with the new UAE Corporate Tax (CT) regime. Understanding corporate tax law and its registration procedures is essential for any business operating in the UAE. Here is a comprehensive guide to help you navigate these requirements.

The UAE Ministry of Finance introduced Corporate Tax in 2022, which will be fully enforced starting June 2023, affecting the financial years of businesses. Consequently, audit firms in Dubai and tax consultants across the UAE are now providing Corporate Tax Advisory and Implementation Services to businesses. The UAE’s Corporate Tax system adheres closely to global best practices and OECD regulations, aimed at reducing compliance risks for businesses.

Corporate Tax Registration in UAE

According to Federal Decree Law 47 issued by the FTA, every taxable entity, including Free Zone Persons, must register for Corporate Tax and obtain a Registration Number. Additionally, the Federal Tax Authority has mandated that even Exempted Persons should register for Corporate Tax.

Taxable Persons are required to submit Corporate Tax returns within 9 months from the end of a specific period. This deadline typically applies to the payment of all Corporate Taxes due for the respective Tax Period in which the return is filed.

In the cases specified by the Minister, a Taxable Person is required to register for Corporate Tax with the Federal Tax Authority using a specific format and within a timeline established by the authority.

The Authority mandates that the Taxable Person or Independent Partnership register for Corporate Tax and obtain a Tax Registration Number. The Tax Authority should exercise unique judgment regarding Corporate Tax Registration from the day an individual becomes a Taxable Person.

Once completing corporate tax registration, taxable persons are required to pay a standard Corporate Tax rate of 9% on taxable income exceeding AED 375,000, while income up to AED 375,000 is taxed at 0%.

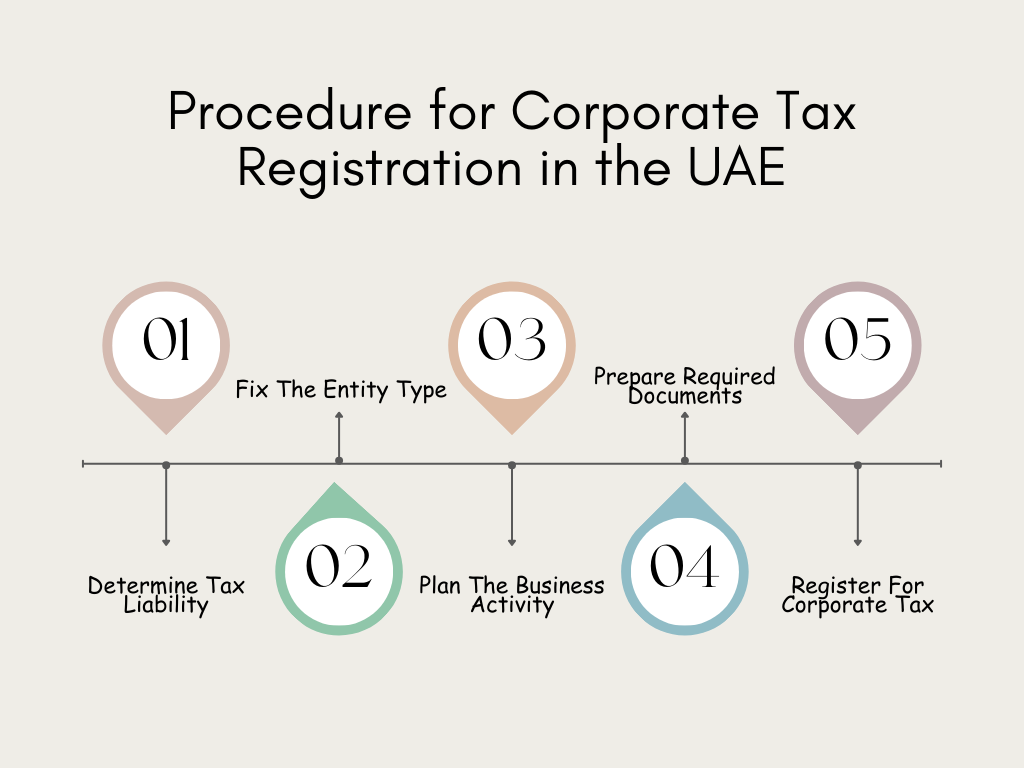

How Do You Register for UAE Corporate Tax?

The Federal Tax Authority has announced the pre-registration of corporate tax on the Emara Tax platform. This online portal allows taxpayers to manage all aspects of tax registration, returns, refunds, deregistration, and payments in one place. Additionally, VAT payments can be made easily using the user-friendly Emara Tax portal.

You can create a new account or migrate your existing FTA account to Emara Tax by following this simple Emara Tax login guide. Ensure you submit all the required documents for UAE corporate tax to complete your registration successfully.

Here is the user manual for registering for corporate tax on Emara Tax.

The Need for Corporate Tax Registration in the UAE

The UAE Government, in collaboration with the Ministry of Finance, has introduced a tax framework and legislation designed to provide advantages for companies subject to corporate tax. If you’re a business liable for corporate tax, you can enjoy the following benefits:

- Staying compliant with the tax law and following up on changes

- Identifying malicious tax practices

- Following the world-class tax standards

Corporate tax registration is crucial for minimizing the post-tax revenue of companies, thereby enhancing returns to shareholders. This not only affects individuals with direct shareholdings but also indirect shareholders through private pensions or investment funds.

Corporate tax payments offer greater advantages to business owners compared to individual income tax payments.

Who qualifies for exempt from UAE Corporate Tax?

While the Federal Tax Authority requires Exempted Persons to register for Corporate Tax, exempted businesses are subject to a 0% corporate tax rate.

There are categories that are exempted from Corporate Tax. Let us look at some of them:

- The employee’s salary will not be affected by Corporate Tax. However, if the individual gets income from activities conducted under a freelancing license, then he/she will be charged with the company tax

- Shares or similar assets resulted in dividends, capital gain, or any income earned by personal potential

- Investment in real estate is legal in the UAE until the investor has no business license

- Potential intra-group transactions or reorganizations will not be affected by the Corporate Tax

- Corporate Tax will not be charged on the foreign investor’s income from dividends, gains, royalties, and similar investment returns unless obtained through business or business activity

If you own a business in UAE, read to know if your entity is exempted from corporate tax or not

Who is required to register for Corporate Tax?

Every taxable individual, including those in Free Zones, must register for Corporate Tax and obtain a Registration Number.

As per the UAE Law for Corporate Tax, there are conditions for tax registration, which are as follows:

- Mandatory Registration

- Registration at the choice of FTA

If your business falls within the scope of the Corporate Tax policy, it is essential to apply for Corporate Tax registration in the UAE. Upon registration, you must obtain a Tax Registration Number within a specified timeframe. YUGA ACCOUNTING

tax consultants assist businesses throughout the Corporate Tax registration process.

The Federal Tax Authority mandates that specific individuals, such as exempt persons and autonomous partnerships, register under the Corporate Tax policy and obtain a Tax Registration Number.

Timeline for Corporate Tax Registration

The Corporate Tax registration process commences in early 2023. For instance, for a business with the initial tax period starting from June 2023, registration for Corporate Tax must be completed within 26 months, by January 2023, with the return filing date set for February 2025. Upon registration, UAE businesses will have up to nine months from the end of the relevant tax period to submit their tax returns to the Federal Tax Authority and settle the Corporate Tax.

Why is Corporate Tax Assessment necessary before Registration?

Assessing the risks and legal factors of a business before and after implementing corporate tax is crucial for ensuring compliance with the country’s tax regime. Without a thorough assessment of corporate tax requirements, businesses may face fines and penalties. This assessment encompasses impact analysis, document review, and tax compliance evaluation. It’s advisable to engage professional corporate tax consultants or firms offering high-quality corporate tax assessment services for a comprehensive evaluation.

Below, we outline Corporate Tax Registration services designed to streamline and expedite your registration process.

Services for Corporate Tax Registration

YUGA ACCOUNTING has the most qualified and experienced tax consultants with extensive expertise in Corporate Tax registration. YUGA ACCOUNTING has tax advisors who provide quality services in the registration process for Corporate Tax.

Our team is quite aware of the major changes resulting from the implementation of Corporate Tax. The early preparation of corporate tax compliance saves a lot of costs and minimizes the stress on the team. With the extensive expertise and experience of the tax consultants at YUGA ACCOUNTING, you can be assured of smooth and unlimited transformation.

YUGA ACCOUNTING assists you with updates on Corporate Tax Registration and filing CT returns, so you stay compliant with the regulations and save from fines and Penalties.

Have queries on Corporate Tax Registration for your business? Call YUGA ACCOUNTING Dubai or YUGA ACCOUNTING AJMAN.

Frequently Asked Questions (FAQ);

1.Corporate tax registration fees in UAE?

UAE resident businesses must register for VAT if their taxable supplies exceed AED 375,000, while voluntary registration is available if supplies reach AED 187,500. Non-resident businesses must register for VAT regardless of their turnover if they make taxable supplies in the UAE.

2.How much is corporate tax in the UAE?

Participating Interests in the UAE are taxed at a 9% effective tax rate (ETR) on their income. This ensures all Participating Interests, regardless of their home jurisdiction’s tax laws, contribute a minimum level of tax to the UAE. If a Participating Interest’s home tax laws wouldn’t naturally result in a 9% ETR, the UAE CT Law will recalculate the rate to reach that threshold.

3.Is there a deadline for corporate tax registration in the UAE?

The filing window for businesses whose tax period runs from January 1, 2024 to December 31, 2024 is from January 1, 2025, to September 30, 2025, for the submission of their corporate tax return and payment. Don’t forget to meet this deadline to stay out of trouble!

4.How can I register my company in the UAE?

The Department of Economic Development in the emirate where you intend to locate your business is where you may submit an application in person. Furthermore, there are digital systems that let you register a business online and get a commercial license; you may submit the required paperwork and have a license in a matter of minutes.

5. What are deductible expenses in the UAE?

While most normal business costs in the UAE are tax-deductible, some are off-limits. These include illegal payments like bribes and fines, taxes you already pay like corporate tax and unrecoverable VAT, and money leaving the company like dividends and foreign taxes. Even entertainment gets special treatment – only half the cost is deductible. For specifics on your business, consult a tax advisor.

6.How to register for corporate tax in UAE?

To register for Corporate Tax on Emara Tax, log in or sign up for an account. Add a Taxable Person if needed and select ‘Register’ in the Corporate Tax section. Follow the guidelines, fill in entity details, add business activities, owners (if applicable), and branch details. Enter contact information and authorized signatory details. Review all information, declare its accuracy, and submit your application.