Transfer Pricing in UAE documentation helps companies in determining their tax liability based on the transactions while filing for corporate tax returns. It may impact the amount of taxable income declared in the former, and the transfer pricing documentation must be submitted as part of the corporate tax returns if required by the FTA.

The application of transfer pricing procedures has grabbed abundant attention globally with the increasing importance of transfer pricing on corporate taxation in the UAE. Businesses involved in cross-border transactions realize the importance of transfer pricing.

Large and small business entities suffer high risk as a result of control by the tax department and regulatory standards. Most global organizations plan for cost management options provided by the best transfer-pricing model.

YUGA Accounting helps to develop a tax-effective strategy that optimizes compliance with laws and regulations, thus meeting the transfer pricing requirements. Before that, let us educate you about transfer pricing in UAE and its regulations.

What is Transfer Pricing in UAE?

Transfer Pricing involves establishing prices for goods or services exchanged between various units or divisions of a multinational corporation. In the UAE, these transactions are governed by transfer pricing regulations, which have been influenced by the country’s corporate tax regime.

The transfer pricing rules in the UAE are crafted to ensure that transactions between related parties occur at arm’s length, ensuring they are priced similarly to transactions between unrelated parties under comparable circumstances.

What is an Arm Length Price ?

The Arm’s length price (ALP) is the price of a transaction between two related firms that reflects what would have been paid if the transaction occurred between two comparable independent and unrelated parties, solely based on commercial considerations.

The arm’s length principle holds that related parties should conduct transactions at prices that would naturally arise from typical market competition between independent entities.

The UAE corporate tax law, the Arm’s Length Principle from the OECD Transfer Pricing Guidelines is adopted for transfer pricing regulations. These guidelines mandate adherence to the arm’s length principle in all transactions involving related parties and connected persons.

Determining Arm’s Length Price for Services in Transfer Pricing

In the global business landscape, accurately determining the Arm’s Length Price (ALP) for services exchanged between related entities within multinational enterprises (MNEs) is crucial. When conducted properly, this process can profoundly impact tax liabilities, financial reporting, performance assessment, and profit distribution. It promotes transparency and reduces the risk of tax disputes by ensuring equitable and Transfer Pricing-compliant service transactions.

In Transfer Pricing the services can be divided into two types:

- (“LVAS”)- Low value Added Services

- (“HVAS”)- High value Added Services

Characteristics of High Value Added Services

- Creation or Enhancement of Intangibles

- HVAS involves higher Complexity and high risk

- R&D, Product design, and Technical Services

Characteristics of Low Value added Services

- Routine Support or Administrative services

- They Involve Lower Complexity

- The Services have Minimal Risk

- No Creation or Enhancement of Intangibles in LVAS

Challenges in Determining ALP

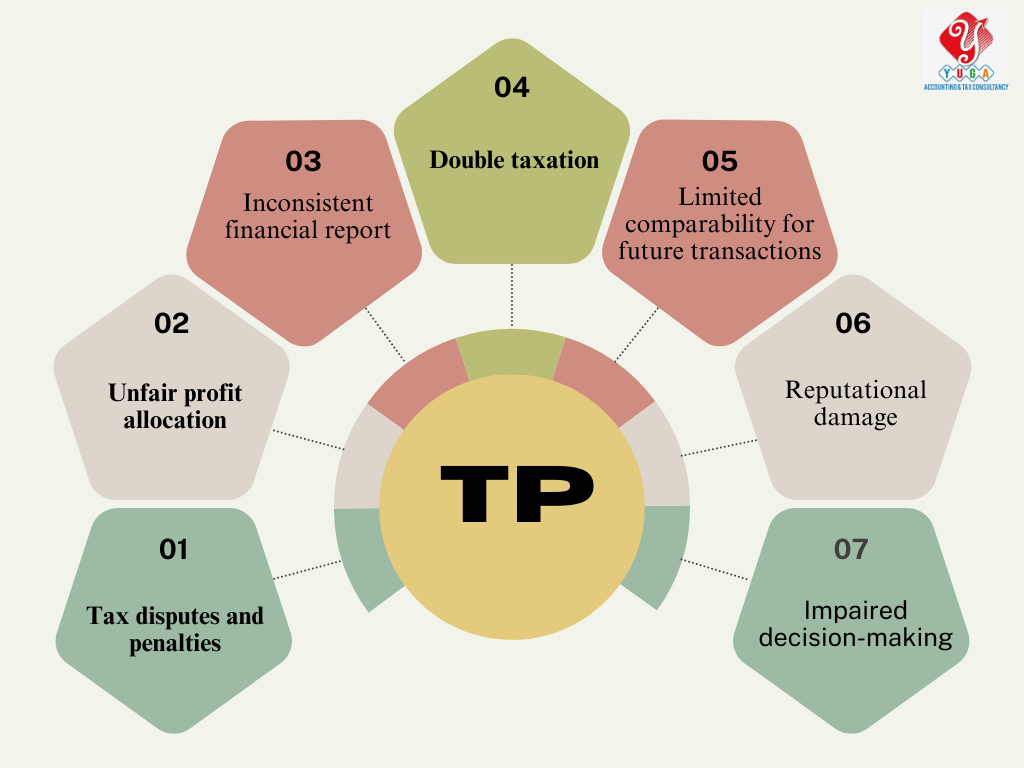

Determining the ALP has several challenges and a few are listed below:

- Allocating costs and risks

- Consistency across Jurisdictions

- Complexity in assessing the value contributed

- Limited Availability of Comparable data

- Challenges in Quantifying Benefits

- Evaluating the economic circumstances .

Factors Affecting the Determination of TP

- Intangible contribution: Adding value through intangible assets including patents, trademarks, and intellectual property.

- Economic conditions: Elements and situations affecting the state of the economy and market dynamics.

- Unique expertise and specialized skills: Specialized knowledge and talents that distinguish people or things from one another, such as unique competence.

- Risk assumption: Accepting the unknowns and exposure to unfavorable outcomes.

- Functions performed: Tasks and obligations are taken on in a professional or operational setting.

- Contractual terms: Agreements spelled out in contracts that specify the parameters under which a business partnership will operate.

Who are the Related Parties?

A related party is an individual or entity in UAE that has a prior relationship with a business that is subject to the Corporate Tax regime due to ownership, control, or kinship (in the case of natural persons).

Who are Connected Persons?

A connected person is an individual or related party who has an ownership interest in or controls the taxable person. For example, A director or officer of the taxable person to the fourth degree of kinship or connection, including via birth, marriage, adoption, or guardianship. You can also be a connected person if you are a partner in an unincorporated partnership or any other partner in the same partnership.

Impact of Transfer Pricing on UAE Corporate Tax

As stipulated by the Ministry of Finance, transfer pricing laws in the UAE mandate that transactions between related parties adhere to arm’s length principles, akin to transactions between independent parties. Businesses in the UAE are required to adhere to these transfer pricing rules and document their transactions in accordance with OECD (Organization for Economic Co-operation and Development) guidelines.

Typically, the Federal Tax Authority reviews and examines related policies, documentation, inter-company transactions, and transactions within groups to ensure compliance with transfer pricing laws.

Importance of Transfer Pricing Documentation

Transfer pricing rules in the UAE mandate that companies maintain documentation supporting their cross-border transactions. This includes analyzing transfer pricing policies, describing transactions and their economic context, and assessing the transfer pricing method used.

Transfer pricing documentation serves businesses in:

- Ensuring compliance with pricing requirements, setting prices, and reporting income accurately.

- Providing tax administrations with detailed information for conducting thorough risk assessments.

Corporate Tax Returns and Transfer Pricing

In the context of corporate tax returns in the UAE, transfer pricing may have an impact on the amount of taxable income that a company declares.

If a company is found to have engaged in transfer pricing practices that artificially reduce its taxable income in the UAE, the FTA may make adjustments to the company’s tax liability based on arm’s length principles.

The local file and country-by-country report, which are part of the transfer pricing documentation, must be submitted along with the corporate tax returns in the UAE if the company meets certain criteria.

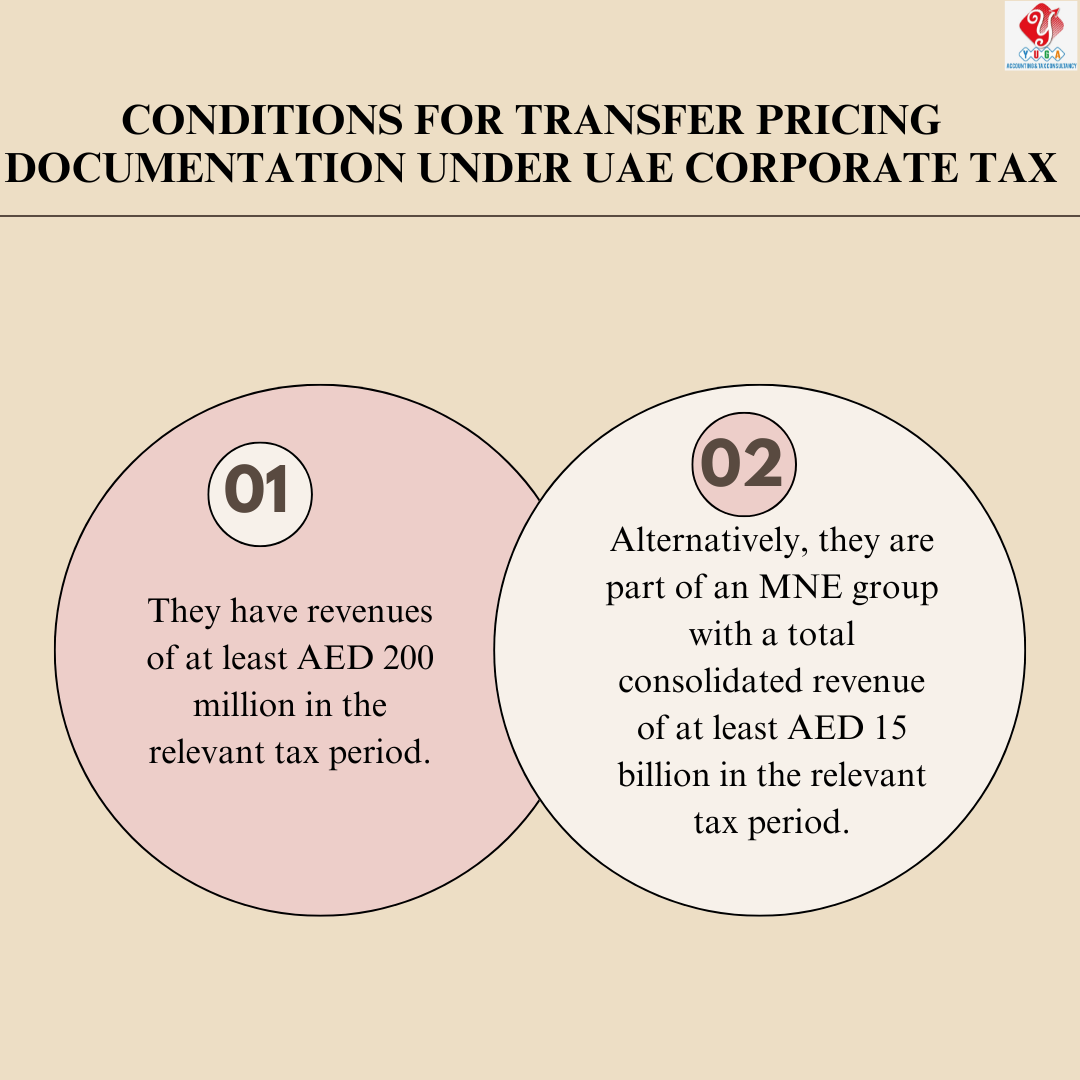

Conditions for Transfer Pricing Documentation in Corporate Tax in the UAE

As per Ministerial Decision No. 97 of 2023, the UAE government announces the conditions for taxable persons to maintain Transfer Pricing Documentation (Master File and Local File) for UAE Corporate Tax. The conditions are given below,

1. A Taxable Person who has transactions with Related Parties and Connected Persons having a total consolidated group Revenue of AED 3,150 million should prepare Transfer Pricing Documents.

2. A Taxable Person who has a Revenue of AED 200 million in the relevant Tax Period.

The Local file should include transactions or arrangements with all of the following Related Parties and Connected Persons if the taxable person is a

- An Exempt Person.

- A Non-Resident Person.

- A resident who is subjected to a different corporate tax rate

- A Resident Person who is elected for Small Business Relief under Corporate Tax Law.

4. The Local file should not include transactions or arrangements if the taxable person is,

- A resident who is not a natural person and a juridical person

- A Natural Person who has independent transactions from parties and arrangements.

- A Juridicial person having independent transactions from unincorporated partnerships.

- A Non-resident is subject to the same Corporate Tax rate as that applicable to the income of the Taxable Person.

NOTE:

Related Parties: Related parties are taxable persons connected through natural persons who are related within the fourth degree of kinship or affiliation, including by adoption or guardianship.

Connected Persons: A connected person is an indirect or direct owner, director, or related party of a taxable person.

At YUGA Accounting , the leading audit firm in Dubai, we have the best auditors and tax consultants in the UAE. We can assist you in preparing transfer pricing documentation in compliance with UAE corporate tax guidelines.

Transfer Pricing Documentation Model under OECD Guidelines

According to OECD guidelines for Transfer Pricing, authorities utilize a three-tier approach for documentation, which includes:

- Local File: Detailed information on transactions of the local taxpayer.

- Country-by-Country Report: Overview of the global allocation of the group’s income and taxes paid.

- Master File: Standardized information relevant to all members of the group.

Local File

A local file, required under UAE transfer pricing regulations, provides detailed information on a company’s transfer pricing policies and related transactions. Companies engaging in cross-border transactions with related parties must prepare this document annually, irrespective of the number of transactions.

- Analysis of risk

- Description of related party transactions

- Supporting documentation

- Overview of transfer pricing policies and practices

- Description of market conditions

- Analysis of the transfer pricing method

- Explanation of pricing mechanism

Country-by-country report

A country-by-country report is a transfer pricing document that provides detailed information on the global operations of a multinational company. In the UAE, the Federal Tax Authority (FTA) requires companies to file a country-by-country report if they meet specific criteria, such as having a consolidated group revenue of AED 3.15 billion or more in the preceding fiscal year.

The country-by-country report must include the following information for each jurisdiction where the multinational company operates:

- Consolidated revenue

- Profit or loss before income tax

- Stated capital

- Accumulated earnings

- Number of employees

- Tangible assets other than cash and cash equivalents

- Business activities of each constituent entity

Master File

A master file is a comprehensive transfer pricing document required under OECD guidelines and UAE transfer pricing regulations. It provides standardized information relevant to all members of a multinational group. The master file should include:

- Organizational Structure

- Business Description

- Intangible Assets

- Intercompany Financial Activities

- Financial and Tax Positions

Transfer Pricing Methods

The arm’s length principle for transactions is assessed by selecting and applying the most appropriate technique. These methods are internationally recognized in transfer pricing.

- Comparable uncontrolled Price method (CUPM)

- Transactional Net Margin method (TNMM)

- Resale price method (RPM)

- Transactional Profit split method (TPSM)

- Cost Plus method (CPM)

Companies should select the appropriate transfer pricing technique by considering factors like information availability, the strengths and weaknesses of each technique, and the nature of transactions. Once a suitable transfer pricing method is identified and a reliable comparison is made, an arm’s length range can be calculated.

Corporate tax advisors based in the UAE

YUGA Accounting UAE provides excellent corporate tax services in the UAE, staffed with tax consultants who specialize in transfer pricing methods. Their expertise ensures accurate calculations and comprehensive assistance for businesses.

For inquiries regarding transfer pricing, contact YUGA in UAE.