The Corporate Tax Filing Deadline in the UAE is 9 months following the end of the financial year. The deadline is usually determined by the financial year of each business. Corporate Tax Deadlines vary depending on each business’s financial year. A detailed overview on the each business’s corporate tax filing deadline is mentioned below.

UAE Corporate Tax

The UAE issued the Federal Decree-Law No. (60) of 2023, amending Federal Decree-Law No. 47 of 2022 regarding the Taxation of Businesses and Companies. Corporate Tax has been in effect since June 1, 2023, and as of 2024, Corporate Tax Registration is currently underway, requiring entities to file the UAE Corporate Tax starting from the current quarter’s financial year (December 2024).

Corporate Tax Filing

Every tax period, a company must prepare and file its UAE Corporate Tax return, as well as any additional schedules that may be required. Regardless of a company’s income or operational status, all UAE taxpayers must submit a corporate tax return. Noncompliance with these tax filing rules could lead to Penalties and fines.

Additionally, businesses must meet the following requirements:

- All Taxable Persons (including Free Zone Persons) are required to register for company tax and obtain a corporate tax recognition number.

- The Federal Tax Authority may also require certain Exempt Persons to register for Corporate Tax.

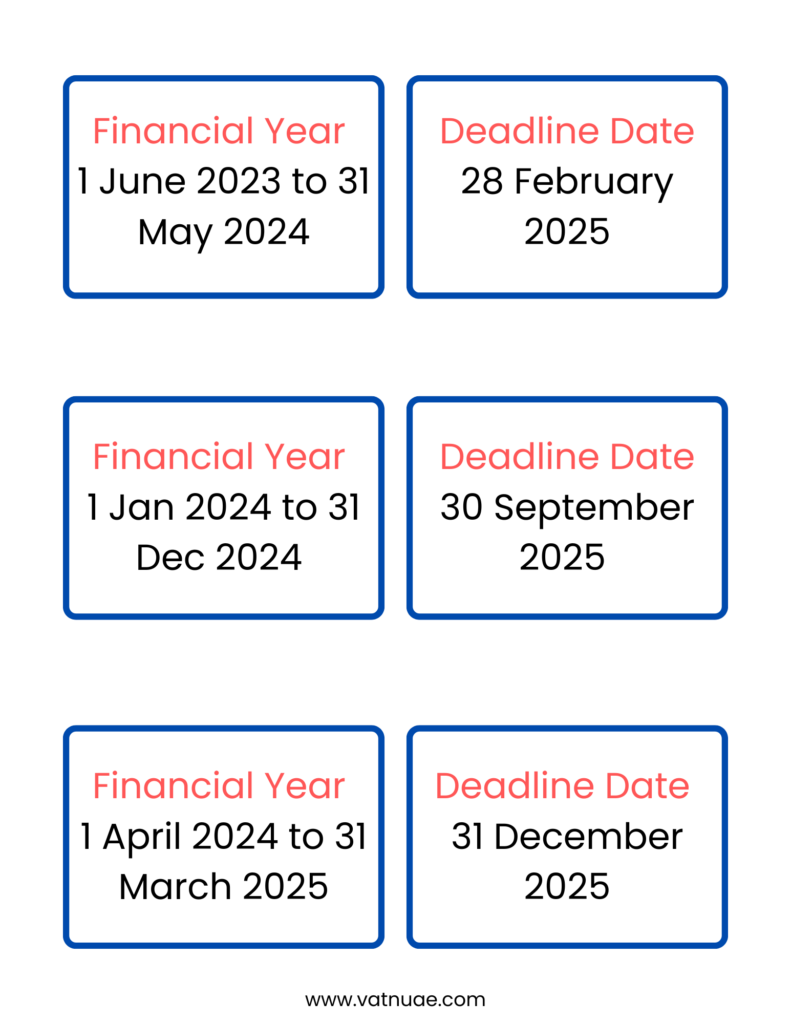

Corporate Tax Filing Timeline

Businesses in the UAE are required to file corporate tax returns once every tax period. Businesses have nine months from the end of their tax deadline to file their company tax return and pay the required amount to the Federal Tax Authority (FTA).

| Financial Year of the Business | Corporate Tax Return Filing Timeline |

|---|---|

| 1 June 2023 – 31 May 2024 | 1 June 2024 – 28 February 2025 |

| 1 January 2024 – 31 December 2024 | 1 January 2025 – 30 September 2025 |

| 1 April 2024 – 31 March 2025 | 1 April 2025 – 31 December 2025 |

Financial Year

1 June 2023 to 31 May 2024

The Corporate Tax Filing Deadline for the first tax period, which runs from 1 June 2023, to 31 May 2024, is expected to be from 1 June 2024, to 28 February 2025, giving businesses a total of nine months to comply with reporting requirements by filing their corporate tax returns and relevant documents.

1 January 2024 to 31 December 2024

The tax year for these businesses’ would run from 1 January 2024 to 31 December 2024. The equivalent Corporate Tax return filing period lasts nine months, beginning 1 January 2025 and concluding 30 September 2025. Businesses have until the deadline to file their tax returns and other necessary documents in order to meet Corporate Tax regulatory requirements.

1 April 2024 to 31 March 2025

These businesses’ financial year spans from 1 April 2024 to 31 March 2025. The tax filing deadline will be available for nine months, from 1 April 2025 to 31 December 2025. Businesses can ensure compliance with all applicable requirements by submitting their tax returns and associated documents before the deadline.

Penalties for Delayed Corporate Tax Return Filing

Failure to file tax returns on time may result in fines or penalties, which vary depending on the length of the delay and the amount owed. Here is an overview of some of the most prevalent fines for UAE Corporate Tax for missing deadlines.

| Violation | Penalty |

|---|---|

| Failure of the Legal Representative to file a Tax Return within the specified timeframes. | 500 monthly for the first 12 months; 1,000 monthly thereafter. |

| Failure of the Registrant to submit a Tax Return within the specified timeframe. | 500 monthly for the first 12 months; 1,000 monthly thereafter. |

| Late submission or failure to submit a Declaration to the Authority. | 500 monthly for the first 12 months; 1,000 monthly thereafter. |

Why Choose YUGA Accounting & Tax Consultancy?

At YUGA Accounting & Tax Consultancy, we provide expert assistance with UAE Corporate Tax filing, ensuring that your deadlines are met, filings are accurate, and penalties are avoided. Our experienced team takes care of the entire tax compliance process, giving you the confidence to focus on your business goals.

Contact us today to make Corporate Tax filing seamless and hassle-free!

FOR MORE INFORMATION, CONTACT US :

Phone : +971 52 1952 532 / +971 4 240 1110

Mail-Id : [email protected]

Website : www.yugaaccounting.com